The Ultimate First Time Home Buyer Checklist – Buying a home for the first time can be scary. There are so many things to do and make decisions that can be paralyzing. To help you, we’ve developed this checklist to guide you through the process so that you can take it one step at a time and get it done right. Preparation

Step 1: Pre-Approval

The first thing you need to do is shop for a pre-approval letter from a bank. They’ll often want a zip code and price range before doing this, but it’s possible to get pre-approval without this. If you’re still months away from looking, a pre-qualification will do but remember that most Realtors and home sellers won’t want to work a deal until you are pre-approved.

Step 2: Find a Realtor

Finding a Realtor is important, but finding the right Realtor is even more so. Find a Realtor who understands your area and is willing to walk you through the process without rushing or blowing you off. Be patient because this can take time.

Helpful resource: 3 Ways to Avoid Paying Realtor Fees

Step 3: Identify Areas

Once you have a pre-approval and a Realtor on board, it’s time to isolate a handful of areas to look within. This will help you focus so that you aren’t driving worldwide and wasting time in places that won’t work for you.

Making an Offer

Step 4: Repairs and Inspections

Your offer must address any issues with the home, such as the need for new flooring or appliances. You’ll also want to make sure that the request is contingent upon inspection so that you can spot problem areas before closing.

Step 5: Escrow and Inspections

Once your offer is approved, you’ll need to route the escrow fee to the seller’s agent, where it will be held in trust. From there, you’ll need to start taking care of the home inspection and any other types of repairs or requests, such as pest treatment.

Step 6: Notify Your Lender

Once the offer is accepted, you must notify your lender to prepare the paperwork. They will guide you through most of this, but they’ll need a lot of detail, which will require a significant portion of your time for the next few weeks.

Step 7: Set the Date

With the help of your Realtor and lender, you’ll set a date for closing. During this time, you’ll need to prepare your funds to cover closing costs and down payment.

Closing

Step 8: Get the Keys!

This is the best step, and it’s the part where you sign the paperwork and get the keys to your home. This is one of the best feelings in the world.

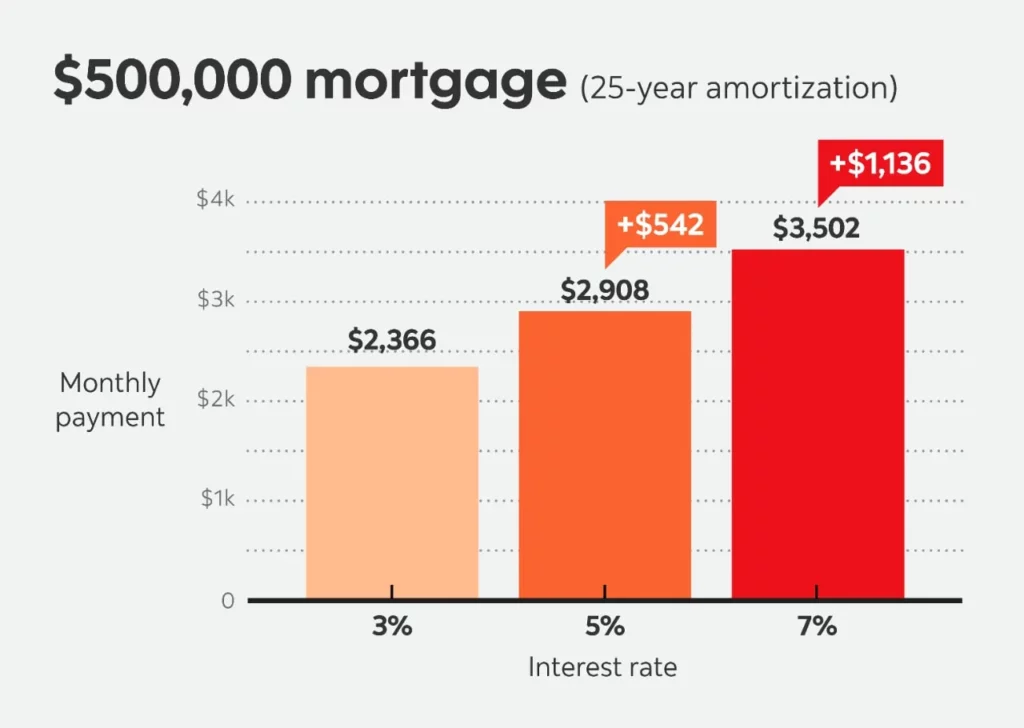

How Much Can You Afford?

Before beginning this process, you must know how much home you can afford. Instead of guessing, use our mortgage calculator & mortgage quotes tool to help you play with the numbers to determine how much you can afford to pay and how much you will need to put down to qualify for that dream home you’ve always wanted. You will also get five free mortgage quotes from trusted lenders in your local area, which you can use to comparison shop. This is a great way to start because you’ll know exactly how much money to request in your pre-approval letter.