Low Canadian Interest Rates – In Canada, interest rates tend to mirror those of their North American counterparts, the United States. As government bonds in both countries have reached similar interest rates, it’s fair to say that the regions with the lowest rates in Canada have much more to do with banks than actual geography.

Throughout most of Canada, mortgage rates are hovering between 3-5%, with five-year fixed rates at the low end of the spectrum and 10-year fixed rates closer to 5.6%. That being said, Ontario is one of the regions with the lowest rates in Canada, with rates about half a percent lower than the rest of the country.

Low Canadian Interest Rates

Quebec also holds lower than the country, at about a quarter of a percent lower than most.

The reasons for the lower interest rates have a lot to do with the stability of the housing market in those areas, though each province has at least one or two regions doing just as well. This is probably best reflected by the fact that the areas with the lowest rates in Canada aren’t that far apart, in percentage points, from those with the worst rates.

Of course, these rates will change as government bonds continue to slide in value, which is why the Canadian government is considering an interest rate hike in the coming months. This could dramatically alter the home mortgage landscape while banks adjust until rates settle. CBC

While fluctuating home values in the United States, Canada appears to be much more stable, and with interest rates as low as the mid-3% range, there’s never been a better time to buy a home. This also goes for those looking to finance, especially if you are in one of the regions with the lowest interest rates in Canada, as you can probably pull out a bit of equity or reduce your mortgage payment without paying a lot of fees or closing costs.

Depending on the rate and bank, you can get into a house for as little as 10% down on a five-year fixed-rate loan and, in some cases, a 10-year fixed-rate loan. TD Bank, ING Direct, CIBC, and Bank of Montreal are just a few lenders leading the market with low rates.

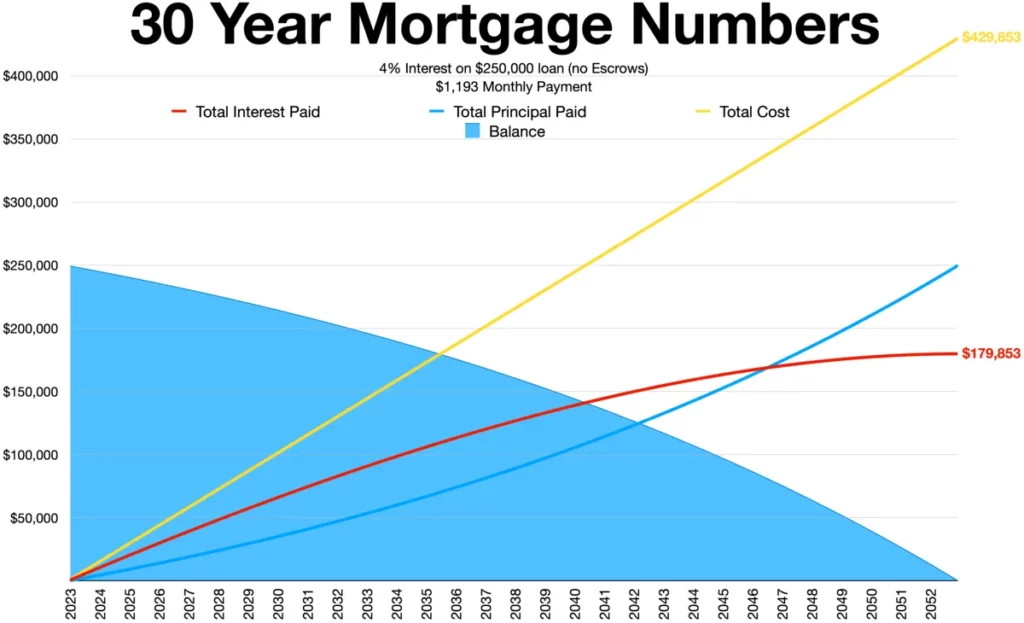

To learn more about the current mortgage climate and the type of rate you qualify for, check out our free mortgage calculator & mortgage quotes website, where you can get five free mortgage quotes from qualified lenders in your area. From there, you can look at our free mortgage calculator to play with the numbers to see where you stand regarding down payment, monthly payment, and total home value. Our free mortgage calculator is also great for those looking to refinance but unsure whether it’s worth the cost. You can compare your current loan with a new loan with lower rates and see how the payment differs.