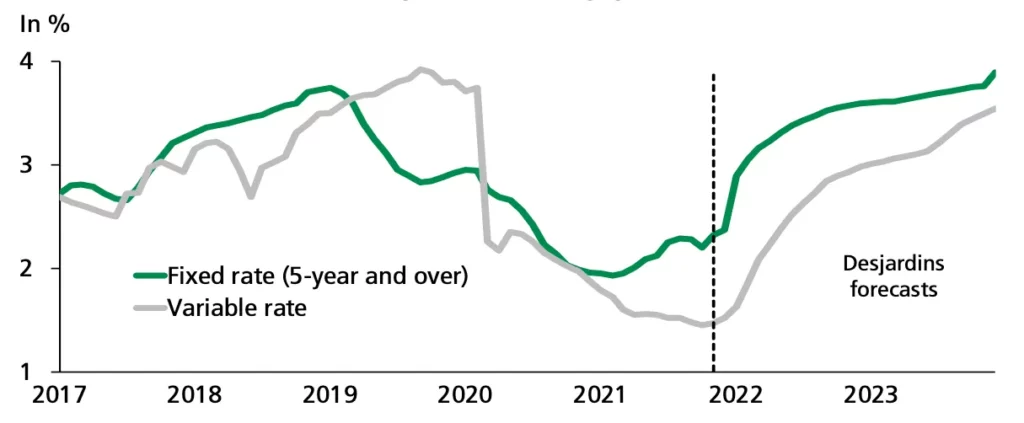

Mortgage changes in Canada – Lower interest rates aren’t the only new happenings with Canadian mortgages Hoping to avoid the financial bust that leveled most housing markets around the world, the government of Canada has made significant rule changes regarding their involvement in government-insured home mortgages.

Mortgage changes in Canada

Not sitting on their laurels despite Canada’s housing market coming out relatively unscathed from the financial crisis, the changes are designed to promote market stability, increase home ownership and reduce risk and leverage in the market. They will also apply to credit lines secured by a home, which are loans in which a house is collateral. The changes and what they mean are listed below:

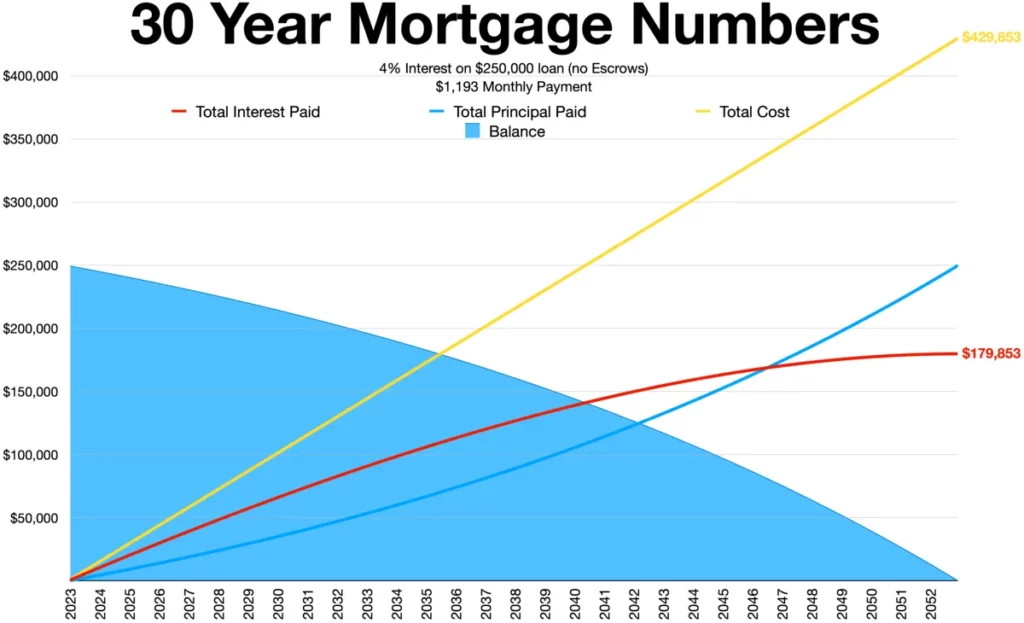

- Taking The Maximum Out Of Maximum … Amortization – Amortization, the years to pay a home mortgage, was dropped from 35 to 30, where the ratio known as the loan-to-value (LTV) ratio is over 80 percent. The LTV is a lending risk assessment tool used by the marketplace and is figured by calculating the mortgage’s principal divided by the property’s value.

- What Does It Mean? – For Canadians, the reduction means higher mortgage payments because they will have to pay their loan sooner but will also result in less interest over the entire life of their mortgage, a change that will save tens of thousands of dollars over the term of a mortgage. Potential homebuyers may also have to wait to save money for a more significant down payment or until prices become more affordable in their area.

- Eighty-Five Is The New 90 – Canadian homeowners refinancing their homes will not be able to borrow as much as in previous years now that the new cap they can leverage against their home’s value is 85 percent rather than the last 90 percent.

- What Does It Mean? – Borrowing against a home valued at $500,000 will mean a difference of $25,000 versus 90 percent, which was the old cap. The difference allows more equity to be kept in the home.

- The Government Is Out Of There – The government also isn’t insuring credit lines borrowed against homes, long considered riskier than initial home loans, because homeowners were folding their high-interest consumer debts, for example, credit cards, into these loans, shifting more risk to taxpayers.

- What Does It Mean? – Banks and other lenders will be getting more cautious about who will be able to secure this type of loan since they will now have to eat the loss if a borrower defaults, and homeowners with low credit scores will have to work harder to improve their credit rating before getting these loans.

The first two changes went into effect last month, while the equity line change kicks in later this month.

The government reducing risk and leverage to the housing market is familiar to Canadians. This is the third occasion since October 2008, when the Canadian government first established the maximum amortization time of 35 years for Canadian-insured mortgages and a minimum 5 percent down payment of the sale price for new Canadian- backed mortgages.

Changes were also made to the loan process, making it harder to offer loans to less-than-stellar credit applicants. read

April of last year saw the Canadians require that buyers put down a 20 percent payment on investment properties to discourage speculation on the housing market; previously, investors only had to put down 5 percent. And the maximum homeowners could refinance their mortgage was dropped to 90 percent from 95.

Canadian consumers can also ensure they know what to expect to pay before purchasing a home by using this easy-to-use mortgage calculator to determine what their home mortgage payments look like with varying interest rates or see what their amortization schedule looks like.