RBC is the largest mortgage lender in Canada, and it has a variety of mortgage products and programs to serve Canadians. Our RBC mortgage rates page and our mortgage payment calculator allows you to see how much you can save by changing your amortization and the difference that payment frequency can make on your payments.

The RBC Mortgage Calculator Canada is a tool the Royal Bank of Canada (RBC) provides that helps users estimate their monthly mortgage payments. It takes into account the following factors:

- Loan amount

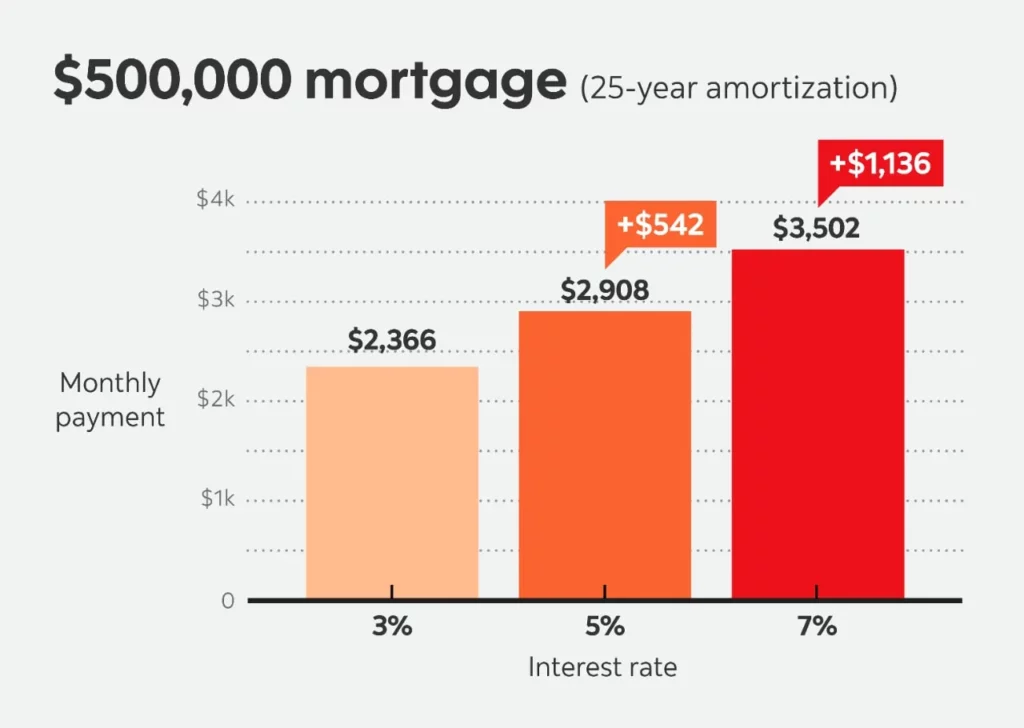

- Interest rate

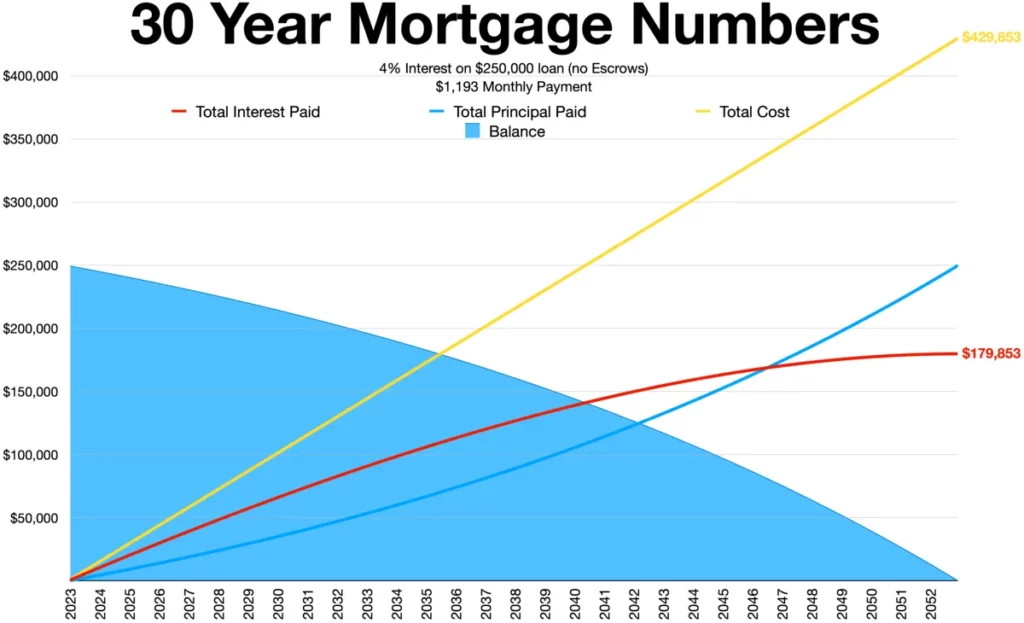

- Amortization period (the number of years it will take to pay off the loan)

- Down payment

- Mortgage type (e.g., conventional mortgage, high-ratio mortgage)

- Payment frequency (e.g., monthly, biweekly, weekly)

- Property taxes

- Home Insurance

To use the Royal Bank Mortgage Calculator, enter the required information and click the “Calculate” button. The calculator will then display your estimated monthly mortgage payment.

You can also use the Royal Bank Mortgage Calculator to compare different mortgage options. For example, you can compare interest rates, amortization periods, mortgage types, and payment frequencies to see how they affect your monthly payments.

Definition of RBC Mortgage Calculator Canada

The RBC Calculator is a free online tool that helps users estimate their monthly mortgage payments. It considers various factors, including the loan amount, interest rate, amortization period, down payment, mortgage type, payment frequency, property taxes, and home insurance.

How to use the RBC Mortgage Calculator Canada

To use the RBC Mortgage Calculator Canada, follow these steps:

- Go to the RBC Mortgage Calculator Canada website.

- Enter the following information:

- Loan amount

- Interest rate

- Amortization period

- Down payment

- Mortgage type

- Payment Frequency

- Property taxes

- Home Insurance

- Click on the “Calculate” button.

- The calculator will display your estimated monthly mortgage payment.

Benefits of using the Mortgage Calculator – RBC

There are several benefits to using the Mortgage Calculator – RBC, including:

- It is free to use.

- It is easy to use.

- It provides accurate estimates of monthly mortgage payments.

- It allows users to compare different mortgage options.

- It can help users make informed decisions about their mortgage.

Overall, the Rbc Mortgage Calculator BC is a valuable tool for anyone considering buying a home or renewing their mortgage.

FAQ

Q: What is the difference between the RBC Mortgage Calculator Canada and other mortgage calculators?

A: The RBC Mortgage Calculator Canada is unique in that it considers a broader range of factors than other mortgage calculators, such as property taxes and home insurance. This allows users to get a more accurate estimate of their monthly mortgage payments.

Q: How accurate is the RBC Mortgage Calculator Canada?

A: The RBC Mortgage Calculator Canada is very accurate. It uses complex algorithms to calculate monthly mortgage payments based on various factors. However, it is essential to note that the calculator is just a tool, and it is always best to speak with a mortgage advisor to get personalized advice and recommendations.

Q: Can I compare different mortgage options using the RBC Mortgage Calculator Canada?

A: You can use the RBC Mortgage Calculator Canada to compare different mortgage options. For example, you can compare interest rates, amortization periods, mortgage types, and payment frequencies to see how they affect your monthly payments.

Q: What should I remember when using the RBC Mortgage Calculator Canada?

A: When using the RBC Mortgage Calculator Canada, it is essential to be as accurate as possible when entering your information. This will help the calculator provide you with the most precise estimate of your monthly payments. It is also essential to remember that the calculator does not consider all of the factors that can affect your monthly mortgage payments, such as your credit score and income.

Q: How do I contact RBC for questions about the mortgage calculator?

A: If you have questions about the RBC Mortgage Calculator Canada, you can contact RBC by phone at 1-800-769-2553 or by visiting an RBC branch.

I hope this answers your questions. Please let me know if you have any other questions.

Source